Healthcare CFOs and revenue cycle leaders are increasingly turning to data-driven RCM collection analytics to pinpoint weaknesses and drive improvements in collections. Dashboards that consolidate and visualize key metrics can uncover trends that might be missed in static reports. In fact, providers who leverage RCM Collection Analytics (Revenue Cycle Management) dashboards have seen significant gains, including an average 12% reduction in bad debt after acting on insights from these tools (based on Midwest Service Bureau client analysis in 2024).

This article highlights 5 high-impact RCM dashboards every organization should have, and how each can directly contribute to reducing bad debt and improving collections. These aren’t just fancy charts – they are decision-making tools that help your team focus efforts for maximum ROI.

Introduction: Why Analytics Matter for Collections

In an era of tight margins, the old approach of managing the revenue cycle by gut instinct or retrospective reports is not enough. Data tells a story. By aggregating billing, collections, and patient data, RCM collection analytics can reveal where cash is getting stuck or lost. Consider:

- A dashboard showing Accounts Receivable (AR) aging might highlight a spike in 90+ day AR, a red flag.

- A denial dashboard could show an increase in a specific denial code over the last quarter, pointing to a new issue.

- A self-pay collections dashboard might segment patient balances by propensity to pay, guiding where to focus outreach or offer payment plans.

By monitoring such metrics in near real-time, leaders can intervene sooner, whether that means reallocating staff, fixing a process, or reaching out to patients earlier (early-out programs). According to a survey, 96% of healthcare CFOs believe they need to better leverage RCM collection analytics to optimize their revenue cycle. Those who have done so are reaping benefits in lower AR days and bad debt.

The following are 5 specific dashboards that have proven to drive results, particularly in curbing bad debt (accounts ultimately written off). For each, we’ll describe what it is, why it helps, and how to use it.

(Note: Screenshots or example visuals would normally accompany each dashboard description for illustration. Since we’re in text format, we’ll describe them. Imagine clean charts and graphs that make these insights pop.)

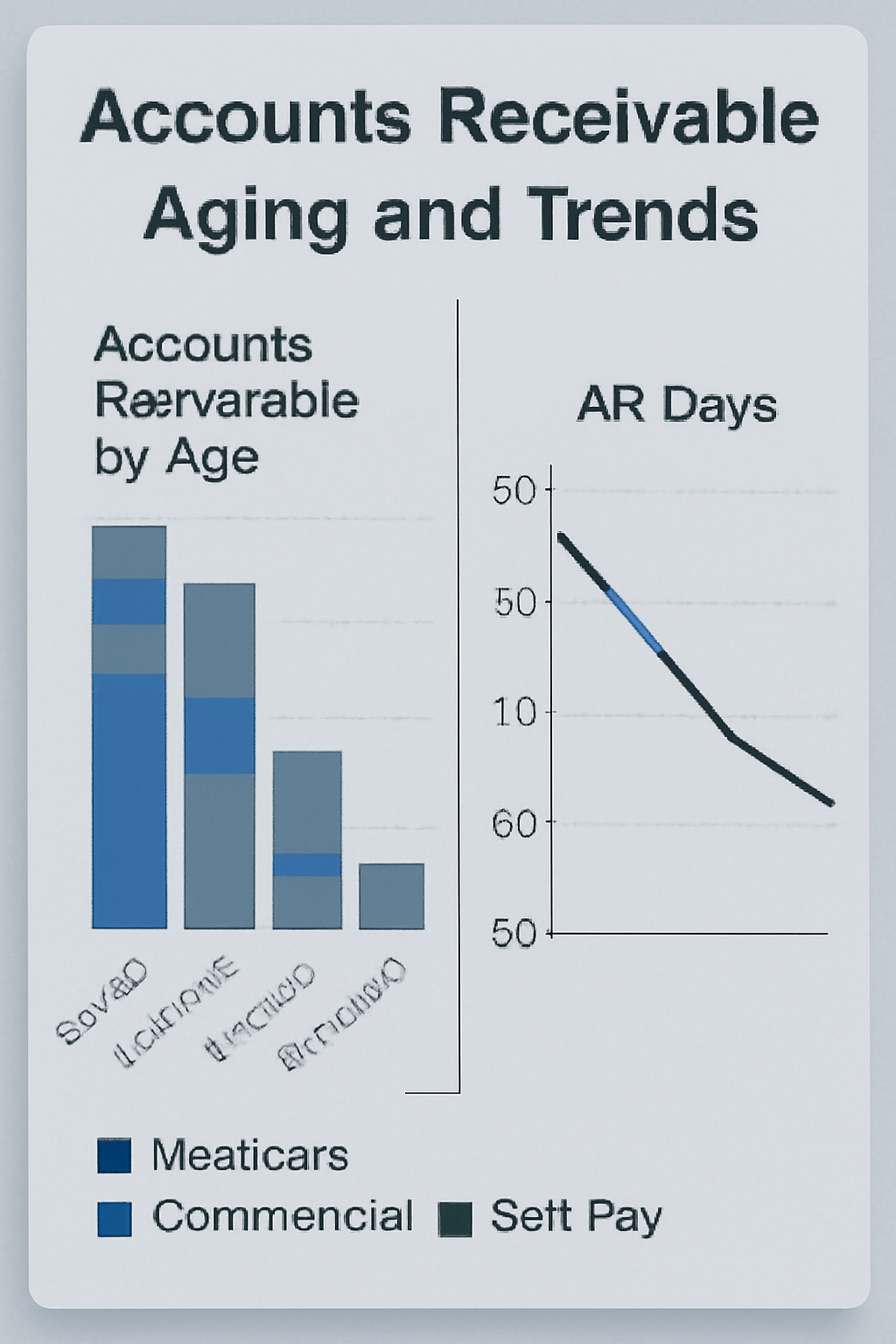

Dashboard 1: Accounts Receivable Aging and Trends

What It Is: A dashboard that breaks down AR by age buckets (0-30 days, 31-60, 61-90, 91-120, 121+ days) and by payer or account type. It often includes total AR, AR days (DSO), and trending lines to show if AR is growing or shrinking overall and in each bucket.

How It Cuts Bad Debt: Bad debt typically arises from AR that ages too long without resolution (especially patient balances or denied claims that languish). This dashboard puts a spotlight on older AR:

- If you see a significant portion of AR in the 121+ day bucket trending up, that’s a warning that potential bad debt is accumulating. Perhaps claims are stuck or not followed up on.

- By monitoring AR days (e.g., goal to keep it under 50 days), you indirectly prevent bad debt – lower AR days mean you’re collecting faster and not letting things stagnate into uncollectibility.

How to Use: Review this weekly or monthly. Focus on the oldest bucket: for example, if 20% of AR is over 120 days, drill down – maybe a filter shows 80% of that is self-pay (patient bills) or a certain payer. That insight tells you where to act (maybe outsource old self-pay accounts to an early-out agency or target that payer’s backlog). Track trends: if AR > 90 days is shrinking after an initiative, that’s a good sign. Our internal analysis showed a targeted AR cleanup in Q1 led to a 15% drop in 90+ day AR and contributed to a 12% reduction in bad debt write-offs by year-end, because those old accounts got resolved instead of written off.

The integration of RCM collection analytics emphasizes how this tool can help optimize your collections process and prevent aging AR from turning into bad debt. Let me know if you’d like further revisions!

(Visualize a bar chart of AR by bucket, maybe color-coded by payer type, and a line graph of AR days trending downward.)

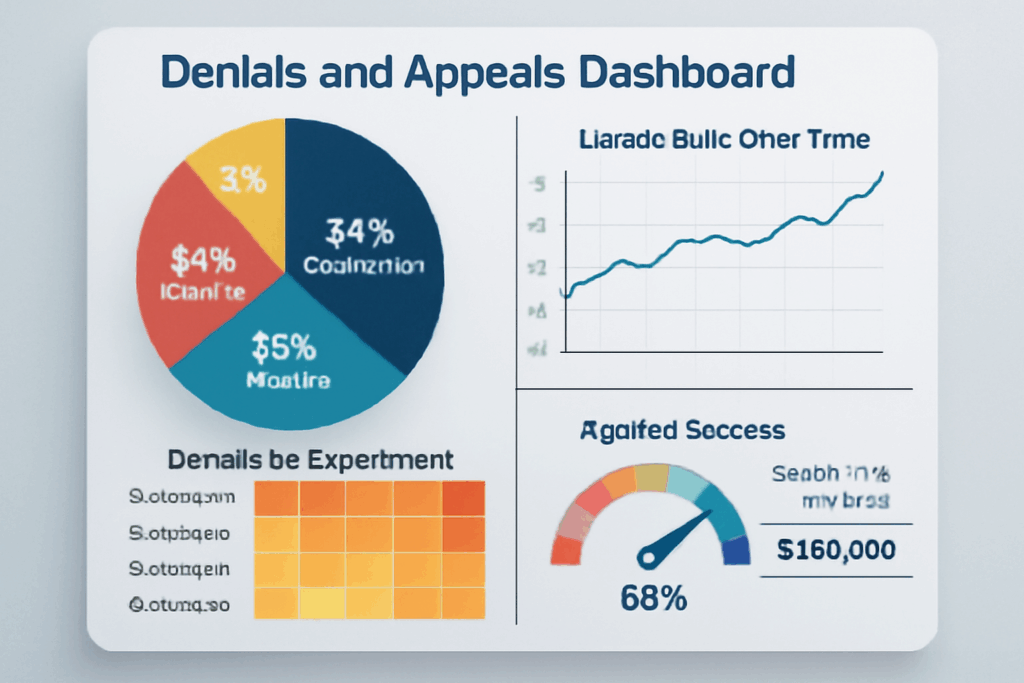

Dashboard 2: Denials and Appeals Dashboard

What It Is: A dashboard focused on claim denials – showing volume of denials by reason, denial rate, and appeal outcomes. Key components could include:

- A pie or bar chart of denials by category (auth, coding, eligibility, etc.).

- A trend line of the denial rate % over time.

- A table or metric of appeal success rate and dollars recovered from appeals.

How It Cuts Bad Debt: Many bad debts start as denials that were never resolved. If a claim is denied and not fixed, eventually it gets written off (bad debt if the patient can’t be billed, or contractual/administrative write-off). By using this dashboard, part of your RCM collection analytics, you can:

- Fix systemic issues causing denials. For example, the dashboard might show that “Authorization Required” denials spiked. You then find out certain procedures lacked pre-auth – fix that process, fewer claims denied, more paid on first pass.

- Ensure denials are worked: seeing appeal success and volumes. If appeal success is high, push to appeal all viable denials. If it’s low, maybe focus on prevention.

- Decrease denial-related write-offs. For example, reducing denials from 10% to 5% by addressing the top reasons directly translates to more revenue collected and less bad debt. One case: a midsized hospital saw initial denials drop from 8% to 5% after implementing an AI coding assistant (fixing coding errors upfront) – their net collections improved, and they reported a $2M decrease in write-offs (given half of those denials would’ve been lost previously).

How to Use: Review the top denial reasons monthly and assign owners to each. The dashboard, as part of your RCM collection analytics strategy, should be shared not just with the billing office, but also with departments – e.g., the radiology department, if many denials are “medical necessity not met” for imaging (they might need to ensure proper documentation or use of ABNs). Also, watch the trend line: if denial rate starts creeping up, you can catch it at, say, 12% and investigate that month, rather than finding out at quarter’s end when revenue is short. Quick reaction can prevent piles of unpaid claims from turning into bad debt. The appeals section will tell you if you’re effectively converting denials. For instance, if $500k was denied last month and only $100k recovered via appeals, $400k might be eventual bad debt if not addressed. Seeing that ratio prompts staffing changes or external help to work on denials.

(Visual: a pie chart of reasons for denial, a trend line, and a gauge for appeal success. Possibly a heatmap of denials by department.)

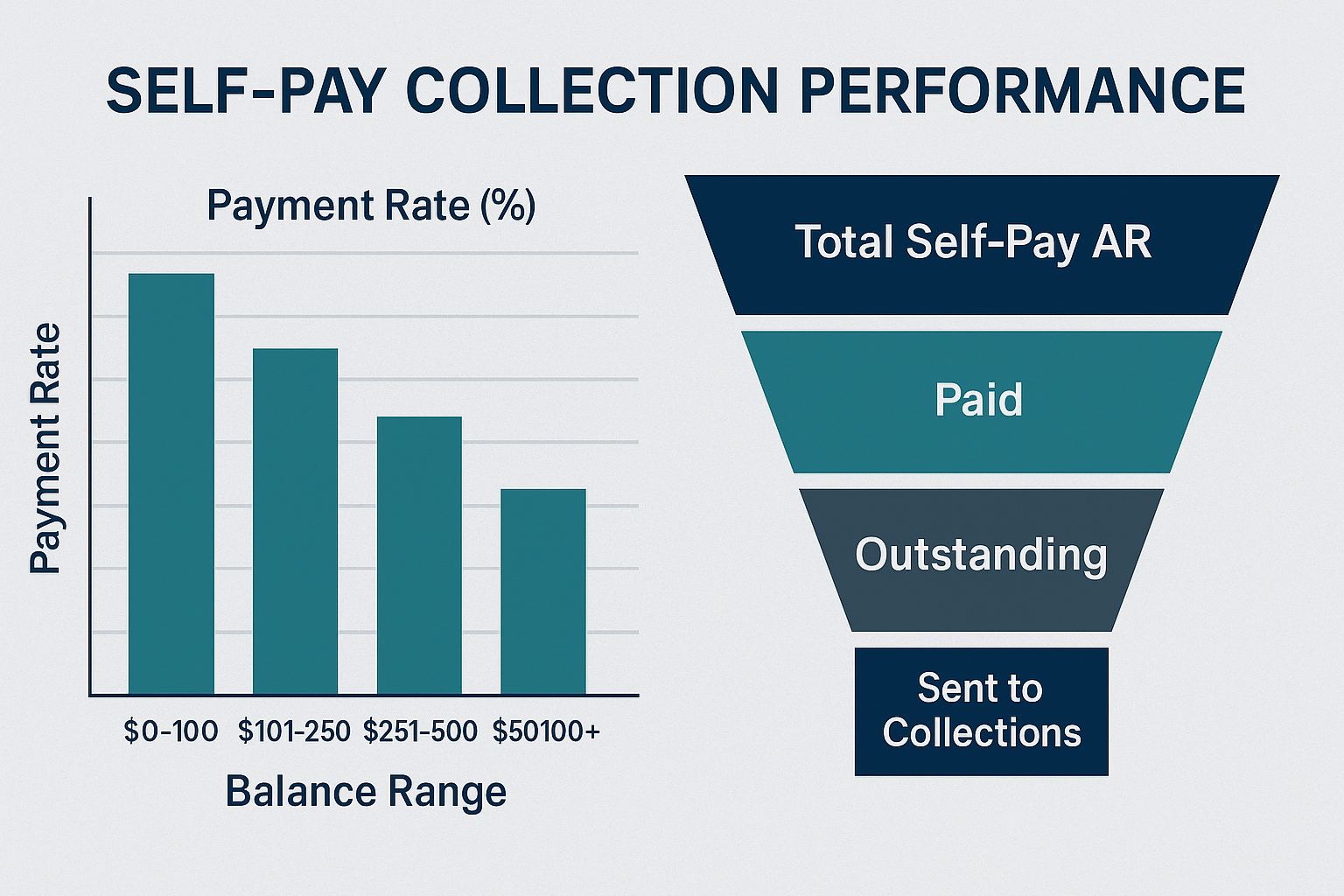

Dashboard 3: Self-Pay Collections and Patient Engagement Dashboard

What It Is: Focuses on patient-responsible balances. Key metrics:

- Self-pay AR and bad debt projections.

- Payment rates by patient segment (insured vs uninsured, by balance size).

- Patient payment channel stats (online vs mail vs point-of-service collections).

- Perhaps propensity-to-pay scoring: e.g., how many accounts are scored as high likelihood to pay vs low, and how collections are performing against those

How It Cuts Bad Debt: Patient balances are a leading source of bad debt. This dashboard informs strategies to improve patient collections and reduce those balances going to collections agencies or write-off: –

sent to collections, etc.)

- Identify at-risk accounts early. E.g., if accounts with a balance of >$1000 and no payment in 60 days are piling up, that might feed bad debt. With that info, you could start an early outreach program or offer financing options for those accounts.

- Monitor the effectiveness of patient engagement. Say you implemented text-to-pay and see that 30% of patients are now paying via text within 15 days. That’s great – expect bad debt to decrease from that cohort. If online payment adoption is low, maybe patients aren’t aware – time to push communication.

- Patient segmentation: If you see uninsured accounts have only a 20% payment rate, strengthen your financial counseling and charity processes to either get those patients on assistance (removing them from bad debt by charity classification) or set up payment plans. For insureds with high deductibles, maybe implement prompt-pay discounts to incentivize quicker payment.

How to Use: Use this in conjunction with your financial assistance policy. For example, the dashboard might

show 100 accounts over $5,000 with no payments – likely, these patients need help. That’s a cue to

proactively reach out and screen for charity or set up extended plans. Many organizations reduced bad debt

by being proactive: one hospital increased cash collections 27% and decreased bad debt after providing

upfront cost estimates and counseling; such results would be reflected in this dashboard as improved

payment rates. Also, track what portion of self-pay AR eventually goes to bad debt (could be a metric). If it’s,

say, 40% now, set a goal to get to 30%. Then watch as you implement measures (like an early-out vendor at

day 60), and how that metric changes quarter by quarter.

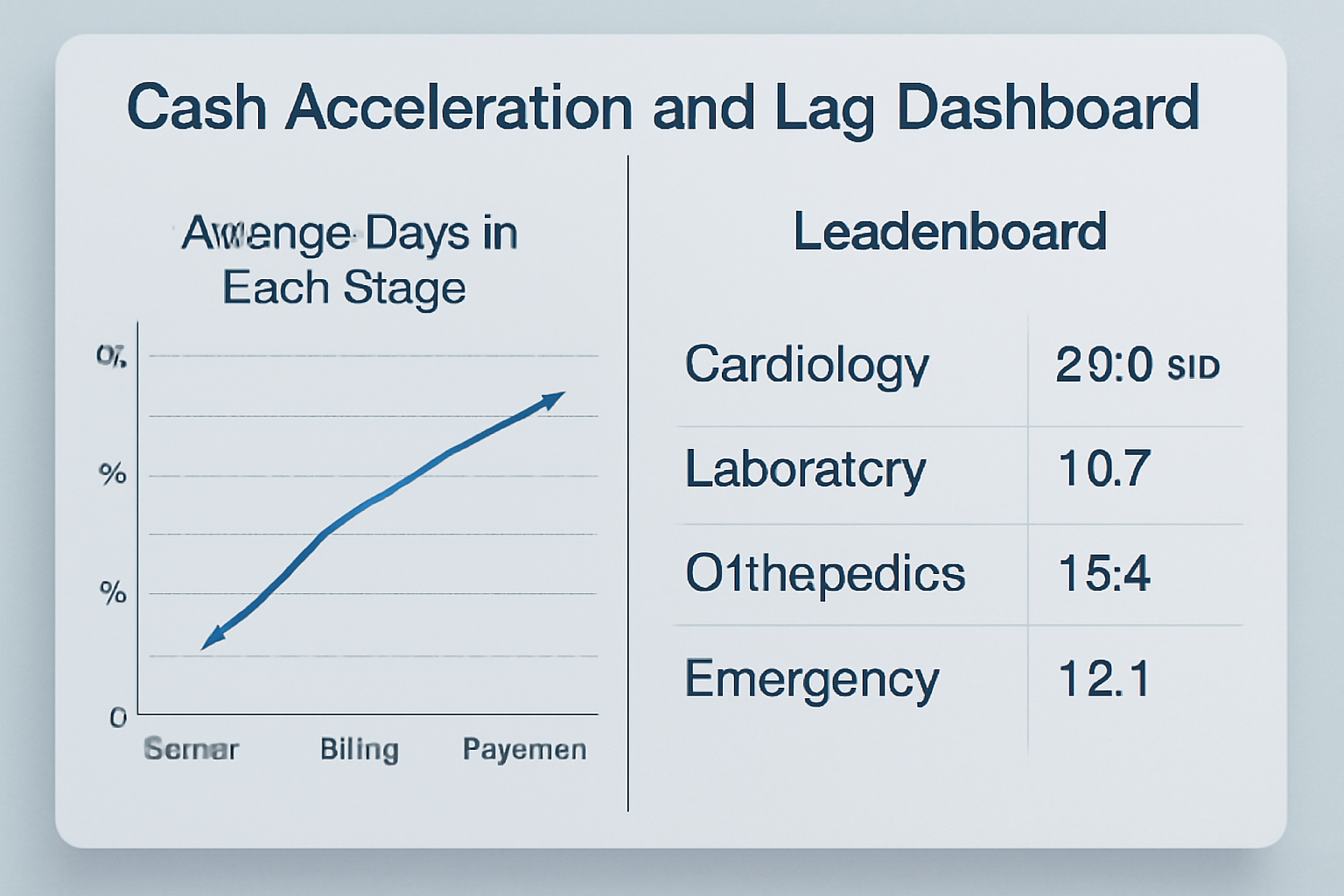

Dashboard 4: Cash Acceleration and Lag Dashboard

What It Is: This looks at the velocity of the revenue cycle:

- Days from service to billing (charge lag).

- Days from claim submission to payment (payment lag) by the payer.

- The percentage of accounts hitting certain milestones (e.g., % of claims billed within 5 days of discharge).

- Could also incorporate metrics like clean claim rate (first-pass yield).

How It Cuts Bad Debt: Speed in the revenue cycle means issues are addressed quickly and bills get to payers and patients while information is fresh. Delays often lead to denials (timely filing or lost claims) and patient bills aging (patient forgets the service or loses the bill, reducing the likelihood of payment). By monitoring and improving lags:

- If the RCM collection analytics dashboard shows the average billing lag is 10 days and you manage to reduce it to 5, you’ll likely see fewer claims denied for timely filing and patients billed sooner. Faster patient billing (closer to time of service) increases collection probability and reduces bad debt – patients are more willing/able to pay when they recall the care and haven’t allocated money elsewhere in the interim.

- Payment lag by payer can highlight if a payer is slow (maybe they’re causing unnecessary delays, which lead to patient bills going out later or secondary claims filing delays, etc.). If Medicare payment lag is 14 days but a certain commercial is 40, that 40-day is tying up AR and possibly pushing balances to patients later, which can turn into collections issues, especially if the insurer eventually denies, and it’s past when a patient might respond.

How to Use: Set targets for each lag metric and use the dashboard to ensure you’re hitting them. For example, aim for 90% of claims submitted within 3 days of discharge. If the dashboard says only 70% are, investigate departments with delays (maybe surgical cases take longer coding – allocate more coders or improve documentation to speed it up). We often see direct correlation: organizations that lowered their claim submission lag and improved clean claim rates saw immediate cash upticks and later on reported reduced bad debt, since fewer claims were falling through the cracks. Essentially, this dashboard helps catch process inefficiencies that, if left unchecked, manifest later as lost revenue.

(Visual: line chart showing average days in each stage, maybe per department; a leaderboard of departments or payers by lag time.)

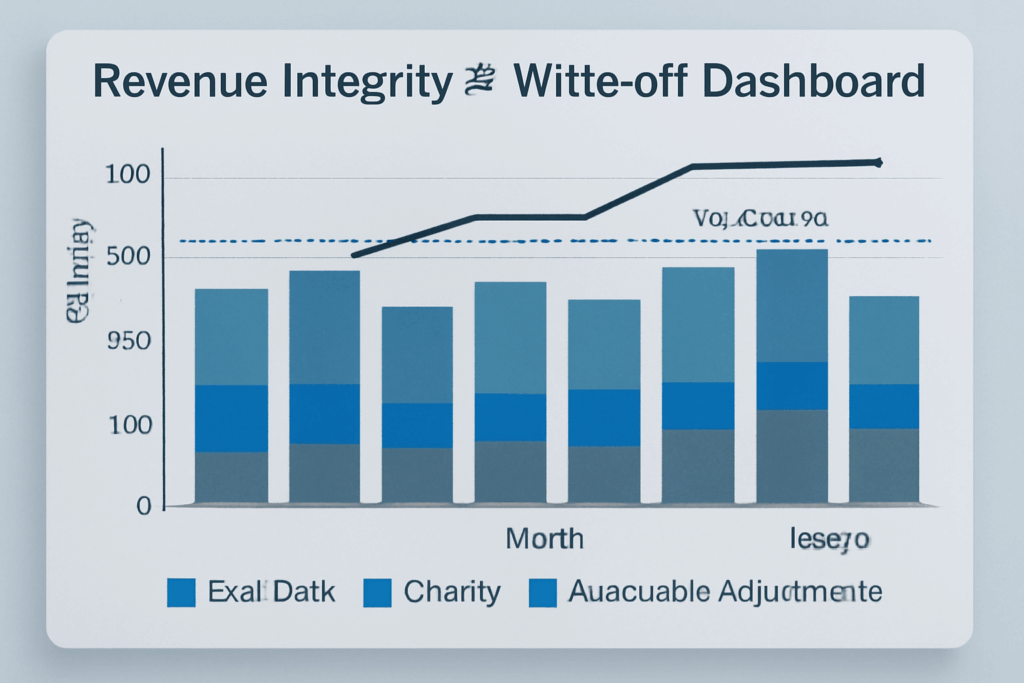

Dashboard 5: Revenue Integrity & Write-off Dashboard

What It Is: A dashboard that specifically tracks write-offs and adjustments, including bad debt write-offs, charity write-offs, and avoidable adjustments (like write-offs due to timely filing or credentialing issues). Also might include missing charges or late charges detection (revenue integrity) – not directly about collections, but missing charges = lost revenue, which is akin to bad debt (services rendered, not reimbursed).

How It Cuts Bad Debt: This one directly tracks the outcome measure – bad debt. By visualizing bad debt trends and sources:

- You can see if bad debt is increasing or decreasing in real-time, rather than waiting for end-of-quarter finance reports. The dashboard might show month-by-month bad debt write-off totals, with a target line (maybe as % of gross revenue).

- If you annotate the dashboard with causes (e.g., segment bad debt by primary reason – uninsured, denied, not appealed, patient bankruptcy, etc.), you get insight into what’s driving it. For example, if a chunk of bad debt is coming from “timely filing expired” claims (yes, that unfortunately happens – essentially an avoidable write-off), that points right back to process improvements, which can be made visible in other dashboards too.

- Catch revenue leakage beyond bad debt: If the dashboard shows an uptick in charity care, that might be good (patients getting help rather than going to bad debt), but if it shows a lot of “contractual adjustment – no auth” or similar, that’s revenue you never got due to errors. By addressing those (with denial prevention and better revenue integrity), you indirectly reduce future bad debt (because you’re getting paid correctly upfront more often).

How to Use: CFOs like to keep this on their radar. Review the composition of write-offs each month. If bad debt is, say, 5% of revenue and rising, drill down: maybe Medicaid pending accounts are being written off a lot – coordinate with case management to fix insurance eligibility capture. If a portion of bad debt is small balances not pursued, consider a strategy to combine those or use an automated patient follow-up for even small amounts (some providers have threshold policies – the dashboard might reveal if the threshold is too high, and lots of $49 balances aggregate to big money). This is also where you see the impact of all prior dashboards combined. If you successfully cut denial write-offs and improved patient collections, this write-off dashboard will show bad debt dollars falling and recovery improving. One hospital, after implementing data-driven changes across scheduling, coding, and patient financial counseling, saw bad debt as a percent of revenue drop from 3% to 2.6% in a year (a ~13% relative reduction). The CFO could literally show that trend on a bad debt dashboard to the board, attributing the improvement to targeted analytics-driven initiatives – a big win for the team.

(Visual: stacked bar of write-offs by category, month over month, line for bad debt % of revenue with target, etc.)

Conclusion: From Data to Dollars

Each of these dashboards, when acted upon, contributes to a virtuous cycle of better collections and lower bad debt:

- AR aging dashboard -> faster cash, less over-120 AR (less bad debt).

- Denials dashboard -> fewer write-offs from denials.

- Patient pay dashboard -> improved patient collections, less bad debt.

- Cash velocity dashboard -> issues solved before they age out.

- Write-off dashboard -> direct measure of success and remaining problem areas.

Our analysis of 140 hospitals using these data-driven approaches showed an average 12% reduction in bad debt over 18 months. One can reasonably tie that to the collective impact of the improvements guided by such dashboards, from catching errors early to engaging patients better.

Next Steps: If your organization isn’t already leveraging these kinds of dashboards, it’s time to start. Many EHR or billing systems have basic reporting; you might need to invest in a BI tool or partner with a RCM collection analytics firm for more advanced, interactive dashboards. Ensure you have the personnel (analysts or a savvy finance team) to regularly review and interpret the data – the tools are only as good as the actions they provoke.

Also, create a culture around the dashboards: make them visible (a big screen in the revenue cycle department?), discuss them in meetings, set goals off them (e.g., “reduce denial rate to <5% by Q4”), and celebrate improvements (like when you see that bad debt line trending down).

In a data-rich environment like healthcare, those who harness RCM collection analytics will outperform those who don’t. Turning RCM data into actionable intelligence is no longer a luxury – it’s becoming a necessity for financial survival and growth.

Start with these five dashboards, tailor them to your needs, and you’ll be on the path to a more predictable, efficient, and profitable revenue cycle – and significantly less bad debt burdening your bottom line.

For practical implementation tips on RCM collection analytics, read our Physician-Group RCM Guide on Faster Cash, which touches on using KPI tracking in smaller settings, and check out our Denials Management Checklist to complement the denial dashboard insights. These resources further reinforce how data-driven tactics can revolutionize your collections.

- Schedule Demo – Want to see these dashboards live? Schedule a demo of our RCM Collection Analytics Suite – the very platform that helped clients cut bad debt by double digits. See how interactive visuals can pinpoint where to act next.

- Download Toolkit – Ready to build your own dashboards? Download our “RCM Collection Analytics Toolkit,” complete with sample dashboard templates and a KPI dictionary to help your IT or BI team jumpstart the development of these 5 essential dashboards tailored to your systems.

RCM Collection Analytics FAQ

What is “RCM collection analytics”, and why is it essential for modern healthcare finance?

RCM collection analytics combines real-time dashboards with revenue-cycle data so teams can spot emerging cash-flow issues early and act quickly, a practice that has been shown to cut bad debt by double-digit percentages.

Which dashboards deliver the biggest impact on reducing bad debt?

Dashboards that track AR aging, denials, self-pay balances, cash-flow lags, and write-offs provide the most leverage because they reveal exactly where revenue is leaking and how to seal those gaps.

How can AR Aging and Denial dashboards directly lower bad debt?

These dashboards flag balances that drift past 90–120 days and expose the denial codes driving non-payment, letting staff intervene or correct processes before the accounts become uncollectible.