The Challenge: Bad Debt Rising Amid Strict Regulations

Hospitals today face a dual challenge on patient bad debt: increasing volume of unpaid bills and intensifying regulations on collection practices. Recent data shows that on average, 1.73% of hospital revenue is written off as bad debt. While that percentage seems small, for a hospital system with $1 billion in revenue, that’s ~$17 million annually in uncollected patient charges – a significant hit. Contributing factors include higher patient deductibles, Medicaid coverage gaps, and economic hardships. Over 100 million Americans have healthcare debt, so hospitals inevitably see more patients unable to pay.

At the same time, the regulatory environment around medical debt collection has tightened. Non-profit hospitals must follow IRS 501(r) rules for extraordinary collection actions and provide financial assistance. New federal laws like the No Surprises Act protect patients from certain bills and have collection implications. The CFPB and state attorneys general are scrutinizing aggressive collection tactics, and major credit bureaus have stopped reporting small medical debts. In short, compliance is paramount – missteps in bad-debt collection can lead to fines, lawsuits, or reputational damage. Understanding the importance of a structured approach, many hospitals are now looking into hospital bad-debt outsourcing strategies to mitigate these risks.

Outsourcing bad-debt collections to specialized agencies is an increasingly popular strategy (a Black Book survey found 83% of hospitals outsource at least some collections) because it can improve recovery and reduce internal workload. However, outsourcing doesn’t absolve a hospital of responsibility. It heightens the need for a compliance-first framework – you must ensure any partner acts as an extension of your values and follows all laws to the letter.

This guide provides a framework for hospitals to outsource bad debt safely and effectively, focusing on compliance and patient-centric practices. We’ll cover the critical components: assessing your readiness, selecting a compliant vendor, defining strict policies, monitoring activities, and measuring outcomes. Also included: a self-assessment widget to evaluate your current compliance level.

By following this framework, hospitals can leverage outsourcing to improve collections on bad debt without running afoul of regulations or community expectations. The goal is a win-win: maximize recovery of owed funds while treating patients ethically and lawfully.

1. Assess Internal Compliance Readiness

Before engaging an outsourcing partner, do a thorough self-assessment of your hospital’s current bad debt management compliance:

- Financial Assistance Policy (FAP): Do you have a robust, board-approved FAP as required for 501(r)? Ensure it clearly defines eligibility criteria (income, assets) and is widely publicized. All patient accounts should be screened against it before being designated bad debt. For instance, confirm that for uninsured or indigent patients, you attempted to qualify them for charity care. No account of a patient eligible for free or discounted care should be outsourced to collections – that would violate 501(r) and undermine community trust.

- Reasonable collection efforts for Medicare: If you seek Medicare bad debt reimbursement, are you following the rules? Medicare requires at least 120 days of collection effort and that the effort be similar to non-Medicare patients. You must also bill any applicable secondary (e.g., Medicaid for dual eligibles) and document the remittance. Confirm your process meets these criteria; if not, tighten it now (e.g., ensure Medicare accounts aren’t prematurely written off before 120 days unless indigency is documented).

- Policies on Extraordinary Collection Actions (ECAs): Non-profits must not engage in ECAs (like lawsuits, liens, credit reporting) without first making reasonable FAP outreach attempts. Do you have clear internal guidelines on when an account can be sent to third-party collections or legal action? Is there a documented 120-day notification period after the first bill before any ECAs, per 501(r)? Make sure these are written and followed.

- Patient communication and billing clarity: Review your billing statements and dunning letters for compliance with federal and state laws. Are they clear, not misleading, and inclusive of required notices (e.g., notice of availability of financial assistance, as many states mandate)? Also, ensure you’re providing No Surprises Act disclosures where applicable (out-of-network emergency or air ambulance bills, etc.) – patients must be informed of their rights and not balance-billed illegally. If a patient has an open surprise billing dispute or a pending charity application, those accounts should be on hold, not sent to collections.

- State law considerations: Many states have laws limiting medical debt collection (e.g., limits on interest, required offer of payment plans, prohibition on garnishing certain patients). Know your state’s rules (for example, California’s AB1020, New York’s hospital financial assistance law, etc.) and verify current practice aligns. Update policies as needed.

- Data security and patient privacy: Collections involve sensitive patient data. Is your internal handling of data (and prospective vendors, see next section) compliant with HIPAA and state privacy laws? Ensure you’ll only share the minimum necessary info with a vendor under a proper Business Associate Agreement (BAA).

By self-auditing with questions like the above, you’ll identify any compliance gaps internally. Fixing those is step one – you don’t want to outsource chaos. Use our Bad Debt Compliance Self-Assessment tool below to gauge your readiness on key points.

2. Select a Compliant, Compassionate Outsourcing Partner

When outsourcing bad-debt collections (typically patient balances aging 120+ days), choosing the right agency is critical. This partner will be interacting with your patients and representing your hospital. Evaluate potential vendors on:

- Compliance track record: Ask about any past regulatory actions or complaints. A reputable agency should have no significant CFPB or state AG fines. They should be bonded/licensed in all states where they collect. Inquire if they follow HFMA’s Best Practices for medical debt collection or have an HFMA Peer Review or ACA International PPMS certification – these indicate commitment to ethical standards.

- Knowledge of healthcare regs: Quiz them on healthcare-specific requirements (501(r), No Surprises Act, Medicare bad debt rules). The best partners are experts – for instance, they should describe how they handle accounts for FAP-eligible patients (answer: they shouldn’t pursue them) or how they ensure surprise bill protections (e.g., not collect beyond in-network amounts).

- Accreditation and training: Do their collectors receive special training in healthcare sensitivity, privacy, and compassionate communication? Look for things like ACA International’s Healthcare Collection Management designation or similar. They should also have HIPAA training – you’ll be sharing PHI under a BAA.

- Patient-friendly philosophy: Emphasize that you are a community hospital and care about patient relationships. The agency should commit to a “patient-first” approach – no harassment, easy payment plan options, and respecting patients’ financial hardship with dignity. Ask if they provide financial education or help patients find coverage (some agencies will assist patients in Medicaid or charity applications, which ultimately benefits both parties).

- Technology and reporting: From a compliance perspective, ensure they have systems to document every contact and every payment in detail (for audit trails). They should be able to report back account-level activity to you, including any disputes or complaints. Ideally, choose an agency that shares account notes or portal access, so your team can see exactly what actions have been taken. Transparent technology is a big plus.

- Secure data handling: Confirm they use encrypted data transfers, secure portals, and have cybersecurity protocols. Ask if they’ve had a HIPAA breach in the past (and how it was resolved). Data security issues can cause legal headaches and PR issues, so this is non-negotiable.

- References and outcomes: Speak to a peer hospital that uses the agency. Specifically inquire: Are their collection rates good, and are they satisfied with how patients are treated? A reference might say, for example, “Agency XYZ improved our bad debt recovery from 10% to 18% of balances, and we haven’t had patient complaints – their approach aligns with our values.” That’s the kind of balance you want. According to industry data, hospitals outsourcing bad debt often improve yield significantly, but it must be done the right way.

Take your time in selection. The wrong partner – one that, say, aggressively sues patients or ignores charity care status – can cause legal trouble and PR nightmares. The right partner will act as a trusted guardian of your hospital’s reputation while improving cash recovery.

3. Define “Compliance-First” Collection Policies

With a partner on board, establish explicit policies and parameters for how they handle your accounts. Don’t assume anything – put it in writing via your contract and procedure manual:

- Accounts to be placed: Clearly define which accounts get outsourced and when. For example: “Self-pay balances over $X that are ≥120 days past initial bill and have received at least 3 statements and a final notice.” Also specify exclusions: e.g., balances below $25 (maybe written off internally as charity or cost-effective measure), any account with an active payment plan or financial assistance application, workers’ comp or accident cases in litigation, etc. This prevents inappropriate placements.

- Verification before placement: Require that, before sending an account to collections, your staff (or vendor as your extended staff) performs final checks: verify no payments received that aren’t posted yet, no Medicaid retro-eligibility, no bankruptcy filing by patient, etc. Some hospitals even do a soft credit check to gauge ability to pay (controversial, but if used, ensure compliance with FCRA and that it doesn’t impact patients’ credit).

- Communication standards: Set guidelines on communication frequency and tone. For instance: “No more than X phone call attempts per week, within 8 am – 9 pm per FDCPA; no calls to the patient’s workplace without consent; all written communications will include our hospital’s approved language about financial assistance availability.” Ensure vendor uses plain language in letters (no overly threatening verbiage). If you have form letter templates you prefer, provide them.

- Permissible collection actions: Decide and document what actions the agency may take on your behalf and what is off-limits. Options to consider:

- Payment plans: Vendor can negotiate payment plans up to 12 or 18 months with a minimum of $50/ month (for example) without additional approval.

- Settlements: Can they offer discounts/settlements on accounts? If so, define the percentage (e.g., they may settle for no less than 80% of the balance on accounts >1 year old, else get hospital approval case-by-case).

- Credit reporting: Many hospitals now disallow reporting altogether due to the regulatory climate and the fact that credit bureaus won’t report under $500 and require a 1-year delay for medical debt. Decide if you want your agency to report larger balances. If yes, ensure they follow new credit bureau rules (e.g., wait at least 12 months, and remove promptly if paid). A compliance-first stance that many hospitals take is to avoid credit reporting entirely to protect patient credit, unless in extreme cases.

- Legal action: Similarly, define if/when legal action (lawsuits, wage garnishments) is permitted. Nonprofits, especially, must be cautious here. Some hospitals flat-out prohibit their agencies from suing patients. Others allow it only for large balances (e.g., over $10,000) and only after thorough review and hospital approval. If allowed, outline steps: vendor must confirm patient is not eligible for assistance and has the ability to pay (perhaps by doing a financial profile) before any legal referral.

- Cease collections on hardship: Instruct the vendor to be flexible. For example, if a patient communicates an inability to pay due to circumstances, the agency should pause collections and refer the account back for charity consideration or special handling rather than doggedly pursuing and violating goodwill or 501(r).

- Compliance monitoring: The policy should require the agency to abide by all applicable laws (list them: FDCPA, FCRA, UDAAP, HIPAA, etc.). It should also stipulate that the agency provides regular compliance reports – e.g., complaint log (any patient complaints and their resolution), call recording access (if you want to randomly audit call recordings for tone and adherence), and documentation of all contact attempts. Essentially, they should be able to demonstrate that they are following the rules (no excessive calls, etc.).

- Patient dispute resolution: Define how patient disputes will be handled. For example, if a patient says “I shouldn’t owe this” or requests validation of debt, the agency must halt collection and investigate, notifying you if an error is found (maybe the insurance was incorrectly applied or a payment was misposted). Have a clear process to resolve these disputes amicably. Often, agencies will send back to the hospital for research any account a patient disputes it beyond a simple validation letter.

- Escalation to hospital: Make sure the contract says the agency will refer accounts back to the hospital in certain cases – e.g., if the patient indicates intent to sue or contacts media, if there’s a bankruptcy notice, if they indicate eligibility for charity care that was missed, etc. You want to handle those directly.

By laying out these policies, you create a playbook the agency must follow. Share it with their management and even frontline collectors if possible. The agency essentially becomes an outsourced arm of your business office, so your policies and ethos should govern their actions.

4. Monitor Vendor Performance & Compliance Ongoing

Outsourcing bad debt is not “set it and forget it.” A compliance-first framework means continuously monitoring and auditing your vendor’s activities:

- Regular reporting & meetings: Require monthly performance reports from the agency: dollars collected, accounts resolved, accounts returned uncollectable, etc., along with aging of what’s with them. But beyond finance, include compliance metrics – e.g., number of accounts on payment plans, number of accounts where legal action was initiated (should be extremely few or none if per policy), any complaints. Hold at least quarterly review meetings to go over these reports and address issues. For example, if collections are lower than expected, why? If there were complaints, what was done?

- Audit sample accounts: On a quarterly or semiannual basis, audit a sample of accounts handled by the agency. This can be done by your internal compliance team or revenue cycle staff. Pick, say, 10 accounts and review: Were the required letters sent? Were the call notes appropriate? If you have call recordings, listen to a few. Ensure they offered financial assistance or followed any scripts correctly. Basically, trust but verify. If you find any deviations (e.g., a collector failed to mention the FAP on a call where the patient said they can’t pay), bring it up and have the agency conduct retraining or corrective action.

- Monitor patient feedback: Keep ears open for patient feedback regarding collections. This includes complaints made to your hospital (a patient calling saying “I got a call/letter from a collection agency and I’m upset”) or even public feedback (social media, etc.). Also, check if any complaints about your accounts show up in the CFPB Consumer Complaint Database or Better Business Bureau. If patients are reporting harassment or unfair treatment by the agency, it’s a red flag to act immediately. One strategy: include a brief survey link on your billing statements (even post-collections) for patients to provide feedback on their billing experience; it can capture issues.

- Performance metrics: Track how much the agency is recovering, but interpret with context. A higher recovery rate is great, but not if it’s achieved via aggressive tactics that hurt community relations. If your recovery jumped from 10% to 20%, and no increase in complaints or charity approvals (meaning they aren’t bulldozing past assistance opportunities), that’s a likely win. Conversely, if recoveries are low, investigate if they are actually working the accounts effectively. It’s possible to be too lenient; the vendor still needs to be assertive within the bounds of respect and law.

- Compliance updates: Stay updated on any new laws or rules and ensure the agency adapts. For instance, if a state passes a new law capping interest on medical debt or requiring itemized bills on request, make sure the agency implements it. They should have a compliance officer who communicates such updates. You, too, should keep them informed if your hospital policies change (e.g., new financial assistance thresholds).

- Revocation rights: Ensure your contract allows you to recall accounts or terminate the relationship if serious issues arise. In worst-case scenarios, if an agency employee were found engaging in abusive behavior, you’d want the authority to pull your accounts immediately. Hopefully, it never happens, but it’s wise to have that lever.

Through diligent monitoring, you maintain control over the outsourced process. This reduces the risk of regulatory breaches. It also helps continuously align the agency’s performance with your expectations. Many hospitals treat their collection vendor as a true partner, sharing data, participating in joint training, etc., which fosters transparency and mutual accountability.

Hospital bad-debt outsourcing can help hospitals manage their financial health while adhering to compliance standards.

5. Measure Outcomes: Compliance and Recovery

Finally, implement a way to measure the success of your bad-debt outsourcing program on both compliance and financial outcomes:

- Compliance scorecard: Develop a simple scorecard to rate the agency (and your internal processes) on key compliance metrics each quarter. For example:

- % of accounts with documented FAP offer before outsourcing: 100% expected.

- Number of FDCPA/consumer complaints: 0 expected (or resolved promptly if any).

- Audit findings: e.g., “10 accounts audited, 1 minor deviation found – 90% compliance.” No Surprises Act violations: 0.

- Timeliness of vendor reports: 100% on-time.

- Reviewing this helps ensure compliance isn’t just assumed but quantified.

- Financial results: Obviously track the collection rate on bad debt placements (e.g., of $X placed, Y% recovered after agency fees). Set expectations based on historical performance and agency promises. If previously internal collections on these accounts were 5% and the agency is getting 15%, that’s a significant improvement. Also monitor cost vs recovery – ensure the net recovery justifies outsourcing. Often it will, as agencies typically work on contingency (taking, say, 15-30% of what they collect). If they collect nothing, you pay nothing (except maybe minimal fees), so it’s low risk.

- ROI analysis: Calculate the ROI of outsourcing bad debt after, say, 12 months. Include indirect benefits: reduction in your staff workload (did you reallocate or reduce FTEs?), higher Medicare bad debt reimbursement capture (if the agency helped document those accounts properly), etc. Many hospitals find that outsourcing not only pays for itself but yields net positive cash that they likely wouldn’t have gotten in-house. Quantifying this helps reinforce the program’s value.

- Community impact: Consider metrics like the number of patients qualifying for assistance during collections. A compliance-first approach might actually funnel some patients into charity care at a late stage (which is okay – better to identify them late than never). Track how many accounts the agency sends back for FAP or how many are settled vs full paid. These speak to their approach. If they’re returning accounts saying “patient likely eligible for charity,” that shows a humane, compliant approach.

- Bad debt as % of revenue: Look at your overall bad debt write-off trend. Ideally, with better patient outreach and collection, you might prevent some accounts from even reaching bad-debt status. Over time, you could see your bad debt ratio stabilize or even decrease slightly, despite industry trends. For example, maybe it goes from 1.8% of revenue down to 1.6%. That is meaningful on a large revenue base.

By measuring both sides – compliance and cash – you ensure the program is achieving the intended balance. Publish these results internally (to the CFO, compliance committee, even the board if appropriate) to show that your “compliance-first” bad debt outsourcing is delivering.

To sum up the framework:

- Prepare internally (policies, screenings, culture of compliance).

- Pick the right partner (due diligence on ethics and ability).

- Specify the rules of engagement (contractual policies).

- Monitor constantly (trust but verify).

- Evaluate success (holistic metrics).

This approach will let you capture as much revenue as possible from hard-to-collect accounts while staying true to your mission and legal obligations. Your hospital can improve its financial health without compromising its integrity or patient trust.

Bad Debt Compliance Self-Assessment

Is your organization ready for compliant outsourcing? Use this quick self-assessment to identify any gaps in

your current process. (Select “Yes” or “No” for each question below to calculate your compliance readiness score.)

Self-Assessment: Hospital Bad Debt Compliance – Answer “Yes” or “No” to each:

- We have a board-approved Financial Assistance Policy and screen all self-pay patients against it before any collections. (Yes=1, No=0)

- We wait at least 120 days and make multiple contact attempts (calls/letters) before deeming an account uncollectible. (Yes=1, No=0)

- Our patient billing statements include a clear notice of financial assistance availability and no “surprise billing” beyond allowed amounts. (Yes=1, No=0)

- We do not take legal action or credit report on patient debt without offering payment plans and checking for Medicaid/assistance eligibility. (Yes=1, No=0)

- We have a process to audit our collections (in-house or vendor) for compliance and address patient complaints promptly. (Yes=1, No=0)

Your Compliance Score: X out of 5. (The calculator will tally your “Yes” answers.)

Interpreting Your Score:

- 4–5 “Yes”: You have a strong compliance foundation. Outsourcing can proceed, but maintain vigilance and keep policies up to date.

- 2–3 “Yes”: Moderate risk. Address the “No” responses (e.g., improve your policy or patient communication) before expanding collections efforts.

- 0–1 “Yes”: High risk. Significant gaps exist – pause and rectify internal compliance issues to avoid legal trouble in collections.

(This self-assessment is for informational purposes; for a detailed audit, consult your compliance officer or legal counsel.)

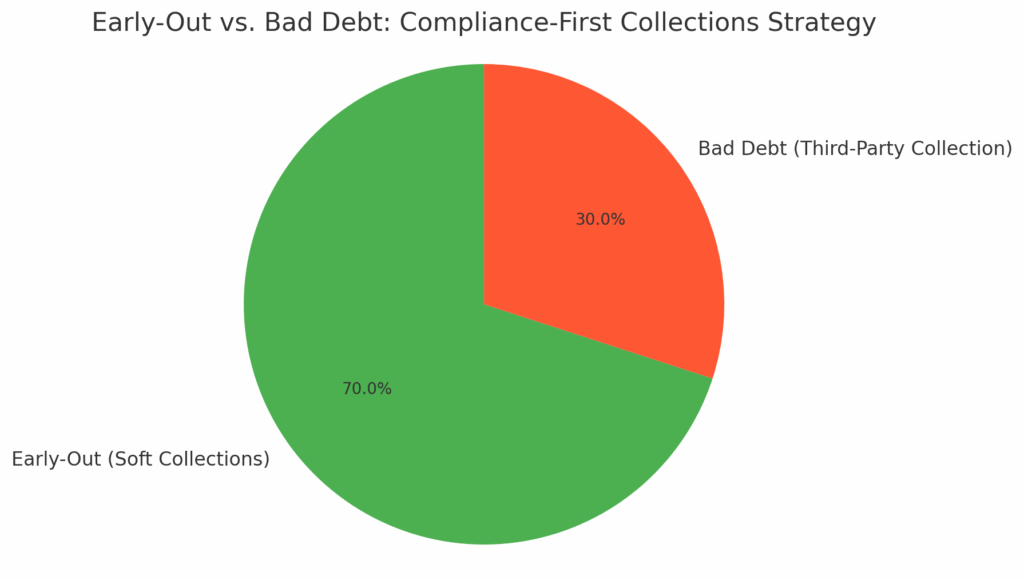

Figure: Early-Out vs. Bad Debt – Many hospitals employ an early-out program to contact patients in the first 60–90 days after billing (soft collections) before classifying an account as bad debt and outsourcing to a third-party collector. This patient-friendly timeline, combined with strict compliance checks, forms the backbone of a compliance-first collections strategy.

Conclusion

A compliance-first framework for outsourcing hospital bad debt is not just idealistic – it’s entirely achievable and, in fact, the most effective long-term approach. By rigorously vetting partners, setting clear rules, and monitoring execution, hospitals can improve cash recovery on delinquent accounts while upholding patient rights and maintaining community trust. The days of aggressive, unchecked medical debt collection are over; today’s environment demands nuance and empathy alongside persistence.

Hospitals that follow this framework often find an unexpected benefit: improved public reputation. Patients recognize when a provider is treating them fairly. Compassionate collection practices can actually enhance loyalty – some patients later resolve their debts when their circumstances improve, precisely because they were treated with understanding, not harassment.

Financially, outsourcing with the right partner can convert bad debt from a write-off to realized revenue. For example, one case study showed that by adopting a patient-friendly but systematic collection process, a health system saw bad debt recovery improve by 5 percentage points without an uptick in complaints. Across millions in bad debt, that is a substantial sum back to the bottom line.

As you refine your bad debt management, remember to keep looping back to compliance: regularly update policies for new laws, train staff and vendors, and engage your finance and compliance teams together in oversight. A collaborative approach ensures nothing slips through the cracks.

Next Steps: If you haven’t already, complete the self-assessment above and discuss the results with your revenue cycle leadership. Use it to fortify any weak spots. Then, if outsourcing is in place or planned, review your vendor contract and communication scripts to align with the recommendations here. It may be useful to host a compliance training session with your vendor’s team and yours together, establishing that shared commitment.

For more insights on patient-friendly collections and regulations like the No Surprises Act, download our toolkit below or read our No Surprises Act Collections Toolkit (a related guide with template notices and state law highlights). You might also benefit from our Early-Out vs. Bad Debt Calculator to fine-tune when to transition accounts to outsourcing.

By treating compliance not as a hurdle but as the guiding principle of your bad debt strategy, you safeguard your hospital’s mission and finances alike. That’s truly a win-win outcome.

- Schedule Demo – Curious how our compliance-focused collections services work? Schedule a demo with Midwest Service Bureau to see our patient-centric bad debt recovery approach and reporting tools in action.

- Download Toolkit – Get the “Medical Collections Compliance Toolkit,” featuring a compliance policy template, patient communication templates (including No Surprises Act notice), and a vendor scorecard to evaluate collection agency performance.

Hospital Bad-Debt Outsourcing FAQs

What are the challenges hospitals face with rising bad debt amid increasing regulations?

Hospitals face a dual challenge of increasing unpaid bills due to higher patient deductibles, Medicaid coverage gaps, and economic hardships, along with stricter regulations around collection practices. Regulatory changes like the No Surprises Act, alongside scrutiny from the CFPB and state attorneys general, make bad debt collection more complex. Non-profit hospitals must also comply with IRS 501(r) rules, which restrict certain collection actions, adding additional pressure on hospitals to adopt ethical, patient-friendly collection strategies.

Why should hospitals consider outsourcing bad debt collections, and what factors should they look for in a vendor?

Outsourcing bad debt collections can help hospitals improve recovery rates and reduce internal workload. However, choosing the right partner is crucial. Hospitals should select vendors with a strong compliance track record, knowledge of healthcare-specific regulations, and a patient-first approach. The right vendor should follow all applicable laws, respect patient privacy, offer flexible payment options, and demonstrate transparent reporting, ensuring the hospital maintains its reputation while recovering bad debt.

How can hospitals ensure compliance while outsourcing bad debt collections?

To ensure compliance, hospitals must establish clear policies regarding which accounts are eligible for outsourcing, verify eligibility before placement, and set strict communication standards with vendors. It’s essential to monitor vendor performance regularly through reporting, audits, and patient feedback to ensure that collection activities align with the hospital’s values. A robust “compliance-first” framework should include training for both internal teams and external vendors, ensuring adherence to all relevant regulations, such as the No Surprises Act and HIPAA.