Understanding Medicare Bad Debt Reimbursement

Under Medicare bad debt recovery rules, Medicare recognizes that despite a hospital’s best efforts, certain patient debts—specifically, unpaid Medicare co-insurance and deductibles—are uncollectible. These are termed “Medicare bad debts.” Rather than leave hospitals wholly unpaid, the Medicare bad debt recovery mechanism reimburses providers for a portion of these bad debts (currently 65 % of allowable amounts). In essence, Medicare shares the burden of covering patients’ unpaid costs.

Which debts qualify? Generally, Medicare bad debt must meet four criteria:

- The debt is related to covered services and is the Medicare beneficiary’s responsibility (deductible or coinsurance).

- The provider made “reasonable collection efforts” to recover the debt.

- The debt was actually uncollectible when claimed as worthless.

- The provider must have established that there’s no likelihood of future recovery.

Types of Medicare bad debt fall into three categories:

- Indigent dual-eligible patients: Medicare beneficiaries who also qualify for Medicaid (often called “crossover bad debts”). Medicare requires you to bill the state Medicaid for these patient balances first; any portion the state doesn’t pay can be claimed as Medicare bad debt. (E.g., if state policy is not to pay Medicare co-pays for QMBs, you need the Medicaid remittance as proof.)

- Indigent non-dual (Medicare-only) patients: These are patients a provider has determined are indigent (meet your financial assistance criteria) but are not on Medicaid. If you’ve properly certified them as indigent, you can write off their Medicare balance without collection efforts and claim it. However, documentation is key (income/assets review, etc.).

- Non-indigent patients: Regular Medicare patients who simply did not pay their co-insurance/deductible after reasonable collection efforts. These require documented collection attempts for at least 120 days.

Why it matters: Medicare bad debt reimbursement can return substantial funds. For example, if a hospital has $1,000,000 in such bad debt, Medicare will reimburse about $650,000 (65%). Failing to claim all eligible bad debts means leaving money on the table. Conversely, claiming ineligible debts (or lacking proper documentation) can lead to disallowances in the audit.

Recent trends: Medicare bad debt rules have seen minor updates. The reimbursement rate has been steady at 65% (though proposals to cut it circulate). CMS has gotten stricter on documentation: Providers must explicitly document income/asset verification for indigency determinations (no presumptive charity without an asset check, except in rare cases) and prove that similar collection efforts were applied to Medicare and non-Medicare patients. In January 2024, CMS updated the cost report’s bad debt worksheet to require more detail, indicating continued scrutiny.

Bottom line: Understanding and adhering to Medicare’s rules is crucial to maximize reimbursement and pass audits.

Step-by-Step: How to Recover Medicare Bad Debts (Claims Process)

To ensure you recover every dollar owed from Medicare for bad debts, follow these steps:

1. Identify Potential Medicare Bad Debts

Throughout the year (or fiscal period), flag accounts that could qualify:

- Run reports of Medicare patients with outstanding coinsurance or deductible bills that went unpaid.

- Typically, focus on accounts aged >120 days with no payment, after normal collection processes. Separate those who received full or partial charity write-offs.

- Example: John Doe had a $200 Medicare outpatient co-pay, was billed, got reminders, but didn’t pay after 120+ days – this could be a Medicare bad debt (if collection efforts met the criteria).

2. Make Reasonable Collection Efforts

For non-indigent Medicare patients, document your collection attempts:

- Issue a bill within 120 days of service or discharge.

- Send follow-up statements (at least one or two more). Make phone call attempts if possible. Document all these attempts (dates of statements, call logs).

- You may use a collection agency as part of the 120-day effort (many do after 90 days). However, do not actually recover the money from the patient after you claim reimbursement; if the agency eventually recovers, you’d have to credit Medicare back its portion.

- Keep evidence: copies of bills, notes of phone calls, and any letters sent. Also, crucially, a statement in your policy that your collection efforts for Medicare beneficiaries are identical to or as aggressive as for other payers (Medicare expects no special leniency beyond indigency).

After at least 120 days without payment (and no active payment plan), and assuming no response, you can deem it uncollectible. If during that time the patient made partial payments, Medicare says the 120-day clock resets with each payment – you must continue efforts from the date of the last payment.

3. Determine Indigence for Eligible Patients

For patients you suspect cannot pay (and aren’t Medicaid), you might classify them as indigent (charity). This must be done before or at the time of write-off:

- Have the patient complete a financial assistance application (or use your presumptive charity policy with necessary data, remembering Medicare requires an asset test in addition to income).

- Collect documentation: income proof (W-2, pay stubs) and assets (bank statements, etc.), consistent with your FAP and 501(r) rules.

- Apply your criteria (often % of Federal Poverty Level, e.g., income <200% FPL for free care). If they qualify, approve them as indigent for the balance. – Document the determination date and keep that on file.

- Note: You cannot simply take the patient’s word as proof (e.g., “patient says can’t afford” is not enough ); you need the analysis on record.

- Once classified as indigent, you do not need to do the 120-day collection effort. Medicare allows immediate write-off of indigent beneficiary balances, since further collection is considered futile and even against policy (you wouldn’t hound charity cases).

4. Bill Medicaid for Dual-Eligibles

For patients who have Medicare and Medicaid:

- Submit the coinsurance/deductible claim to Medicaid (or the Medicaid HMO) and obtain a remittance advice (RA).

- Often, Medicaid RAs will show $0 paid (most states don’t pay Medicare copays for QMBs due to state Medicaid payment rules). That RA is gold – it’s your proof for Medicare that the state had no obligation or didn’t pay.

- If Medicaid paid a portion, only the unpaid remainder is potentially claimable as bad debt. You must subtract any amount Medicaid is obligated to pay, even if they haven’t paid it yet.

- Keep copies of these Medicaid RAs for each account. Medicare auditors will ask for them for any dual-eligible bad debt claims.

5. Compile Your Bad Debt Log

Medicare requires a detailed bad debt listing (often called Exhibit 2 or bad debt log) on the cost report. For each bad debt claim, include:

- Patient identifier (usually an account number or medical record #, not full name on the report for privacy). – Date of service.

- Amount of deductible and/or coinsurance that is being claimed as bad debt.

- Indicate yes/no if the patient is indigent/Medicaid dual (often need to flag dual-eligibles separately).

- If dual-eligible, the state amount owed (if any) and paid (if any).

- Date of write-off (when it was recorded as uncollectible in your books).

- Some logs require a brief indication of collection effort or charity approval.

Ensure the total of this log ties to your financial statements (the bad debt expense for Medicare accounts). Consistency is key.

6. Claim on the Cost Report

On your annual Medicare cost report (Worksheet E series, specifically the bad debts section, historically Worksheet S-10 for hospitals), report the total amount of allowable Medicare bad debt and the reimbursable amount (65% thereof for PPS hospitals; Critical Access Hospitals get 100% reimbursement of their Medicare bad debts, which is a big deal for them). Attach the detailed bad debt log (or have it available).

Double-check categories: Medicare distinguishes between desirable bad debt (from deductible/coinsurance after reasonable effort) and undesirable (e.g., from not doing enough follow-up). Only allowable bad debts after proper effort or indigence determination are reimbursed. If you didn’t do 120 days of effort on a nonindigent case, that account shouldn’t be on the log.

7. Prepare Documentation for Audit

Medicare contractors often audit bad debt claims, especially if the amounts are large. Be prepared:

- Maintain a bad debt policy document that spells out your process, aligning with Medicare rules (auditors ask for this).

- Keep a file for each claimed account with copies of: bills sent, collection letters, Medicaid RA (if dual), financial assistance approval (if indigent), and any other relevant notes (phone call logs, etc.).

- Auditors might sample a handful or many accounts. Any account lacking proper supporting documentation can be disallowed (meaning you lose that reimbursement). It’s not uncommon for tens of thousands of dollars to be at stake, so organize these files meticulously.

8. Receive Reimbursement & Follow Up

Medicare will reimburse the allowed portion via the cost report settlement. For example, if you claimed $1 million in bad debt and none was disallowed, Medicare pays $650k (65%). This typically comes as a lump sum adjustment.

If auditors disallowed some accounts (say they removed $100k as not meeting criteria), you can appeal through the cost report appeals process if you believe they were compliant. It’s critical to address any issues the auditors raised for future cycles – e.g., if they disallowed accounts for missing proof of indigence, tighten that process going forward.

Also, important: if any of those bad debts are later recovered (e.g., patient eventually pays, or Medicaid decides to pay, etc.), you must adjust future cost reports to pay Medicare back its share. Many systems have a mechanism to flag if a payment comes in on an account that was claimed as Medicare bad debt.

By following these steps, you maximize your Medicare reimbursement while staying compliant. It’s essentially “free” money (partial reimbursement) for amounts you weren’t going to collect anyway, but you have to earn it with proper process.

Below is a calculator to estimate your potential Medicare bad debt recovery based on your uncollected amounts – try it to see the opportunity size for your hospital.

Medicare Bad Debt Reimbursement Calculator

Use this simple calculator to project how much Medicare will reimburse you for your uncollectible Medicare patient debts. Enter the total Medicare deductible and coinsurance amount you wrote off as bad debt (after meeting criteria), and apply the reimbursement rate (usually 65% for most hospitals, 100% for Critical Access Hospitals).

- Total Allowable Medicare Bad Debt ($): e.g., 500,000

- Medicare Reimbursement Rate (%): e.g,. 65 (Default 65%. CAHs use 100.)

Output:

- Estimated Medicare Reimbursement ($) – calculated result

For example, if you had $500,000 in qualifying Medicare bad debt and you’re a PPS hospital (65% rate), you’ll recover about $325,000 from Medicare. If you’re a CAH (100%), you’d recover the full $500k.

This showcases why it’s vital to capture all eligible bad debts: every $1 not claimed is $0.65 lost in potential reimbursement.

(Note: Only actual Medicare beneficiary responsibility qualifies. Do not include amounts that were the provider’s contractual adjustments or disallowed services. The calculator assumes the amounts input are truly allowable bad debts.)

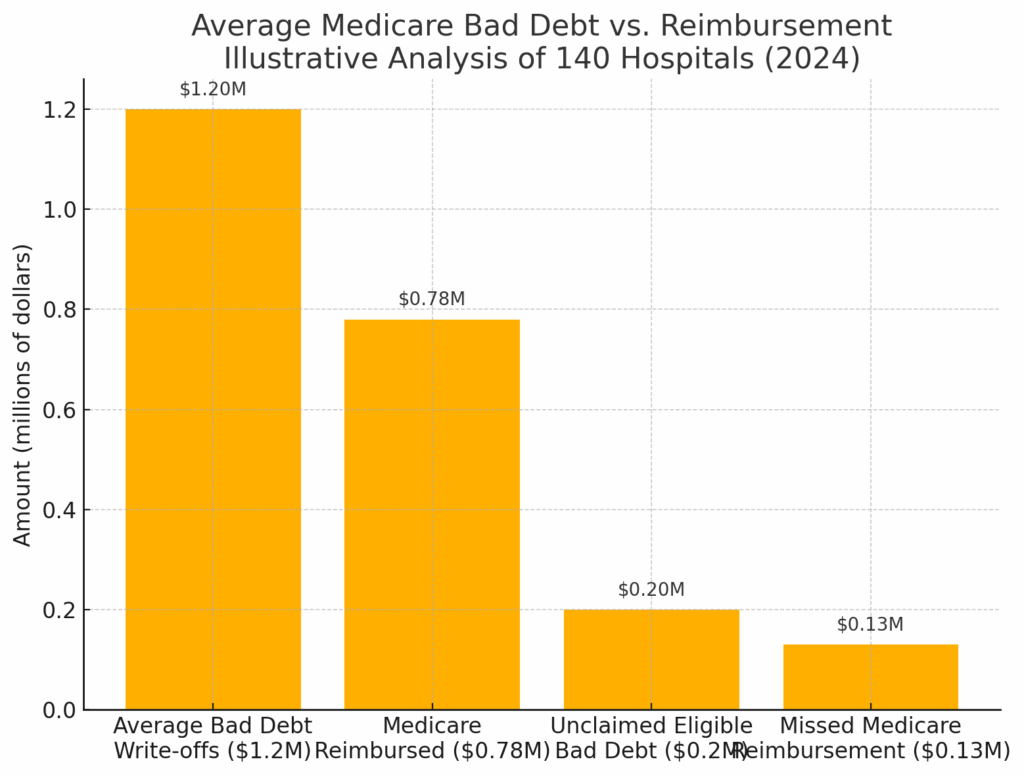

Figure: Average Medicare Bad Debt vs. Reimbursement – An illustrative example from an internal analysis of 140 hospitals (2024). On average, hospitals had $1.2 million in Medicare bad debt write-offs per year, for which Medicare reimbursed about $780,000 (65%). However, due to documentation or process gaps, hospitals failed to claim roughly $200,000 of eligible bad debt on average, translating to about $130,000 in missed Medicare reimbursement. This highlights the importance of thorough bad debt recovery efforts and cost reporting accuracy.

Pro Tips and Best Practices

- Involve Finance Early: The CFO’s team should be intimately involved in tracking and compiling Medicare bad debts. It often falls to Patient Financial Services to do the legwork, but Finance will ensure it gets on the cost report properly. Coordinate these departments

- Train your billing staff: Make sure your collections team knows that Medicare accounts have special considerations. For instance, they should know not to aggressively chase Qualified Medicare Beneficiaries (QMBs) because those patients have no legal obligation to pay per federal law – billing them beyond what Medicaid covers is prohibited. Also, staff should route likely charity cases appropriately rather than continuing to send bills.

- Leverage Technology: If possible, use your patient accounting system’s features or a cost report software to flag and accumulate Medicare bad debts. Some systems let you mark an account as Medicare bad debt with reason codes (indigent, etc.) and then generate a report. This reduces manual errors.

- Stay Updated: Medicare’s bad debt policy can change. For example, keep an eye on any federal legislation or CMS rule-making – there have been proposals to reduce the reimbursement rate (which haven’t passed as of this writing). And MACs (Medicare Administrative Contractors) occasionally release updated transmittals or memos with documentation expectations. A recent example is CMS emphasizing that providers must not use presumptive charity tools for Medicare without an asset review.

- Consider Other Reimbursements: Note that Medicare Advantage plans (Medicare Part C) are not part of this reimbursement program. Debts from those patients can’t be claimed on the cost report; only traditional Medicare fee-for-service. Also, Medicaid (in some states) and other payers might have similar mechanisms – e.g., some states reimburse a portion of Medicaid bad debt – check local policy.

- Collaborate with Other Hospitals: It can be helpful to benchmark your Medicare bad debt ratios with peers. If a similar-sized hospital is claiming more, perhaps they have a better process. Networking via state hospital associations or HFMA could yield tips (like sample indigence determination forms or collection letter templates that satisfy auditors).

Conclusion

Medicare bad debt recovery is a nuanced but rewarding aspect of revenue cycle management. By diligently following the rules and keeping excellent records, hospitals can recoup a substantial portion of what would otherwise be lost revenue. Think of it as Medicare providing a safety net for serving elderly and disabled patients who can’t pay their share.

Let’s recap the essentials:

- Only claim truly uncollectible Medicare patient balances, and prove they’re uncollectible (either through sustained collection efforts or a solid indigence determination).

- Keep every shred of documentation – you’re essentially building a case to justify each dollar to an auditor.

- Timely and accurate cost reporting is the final step to actually getting the money.

For hospitals new to this, the process might seem burdensome, but it often becomes routine once integrated into your workflow. The payoff is worth it: many hospitals receive hundreds of thousands (even millions for larger systems) each year in Medicare bad debt reimbursements. These funds can offset charity care costs and help your facility’s financial stability, effectively supporting your mission to treat Medicare patients even when they can’t meet their obligations.

Next Steps: Conduct an internal audit of last year’s Medicare bad debts. Did you capture everything? Were any claims disallowed that you can correct going forward? Use the calculator above to estimate what you might expect if you improve capture. And ensure your policies for collections and financial assistance are up-to-date with Medicare’s requirements (if needed, update them and retrain staff).

To further strengthen your revenue recovery, consider reading our Denials Management Checklist – reducing claim denials upstream will decrease how many unpaid amounts end up as bad debt in the first place. Additionally, our Hospital Bad-Debt Outsourcing Framework guide can help if you choose to involve a third party in collections while staying compliant.

By mastering Medicare bad debt recovery, you ensure your hospital maximizes entitled reimbursements – a smart move in today’s challenging healthcare economics.

- Schedule Demo – Want to see how technology can simplify tracking of Medicare bad debts? Schedule a demo of our RCM software – we’ll show you tools for automating bad debt logs, generating required documentation, and integrating it with your cost reports for error-free reimbursement.

- Download Toolkit – Download the “Medicare Bad Debt Recovery Checklist & Toolkit,” which includes a printable checklist of documentation requirements, a sample indigence determination form, and a cost report bad debt log template to streamline your process (available after filling out a brief request form).

Medicare Bad Debt Recovery FAQ

What is Medicare Bad Debt Recovery?

Medicare bad debt recovery is the process where hospitals recover a portion of unpaid debts, such as co-insurance and deductibles, from Medicare. Medicare reimburses up to 65% of these bad debts to assist healthcare providers.

What types of debts qualify for Medicare Bad Debt Recovery?

Debts that qualify must involve Medicare-covered services and meet criteria such as being uncollectible after reasonable collection efforts. This includes debts from indigent patients and those who failed to pay after 120 days.

What steps should I take to recover Medicare bad debts?

To recover Medicare bad debts, identify eligible accounts, make reasonable collection efforts, classify indigent patients, and submit claims with detailed documentation on the annual cost report.